Custodial roth ira calculator

What You Need To Know About The Custodial. As of 2022 the IRS allows contributions.

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. There are many IRA. Once the Custodial IRA is open all.

Discover Which Retirement Options Align with Your Financial Needs. Traditional IRA Calculator can help you decide. Retirement Nest Egg Calculator.

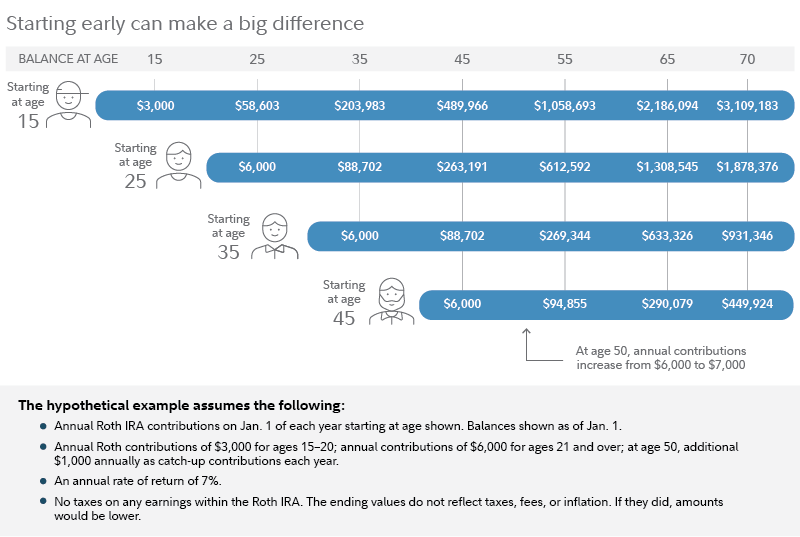

Traditional IRA Calculator can help you decide. Contribution limits For 2021 the contribution limit for custodial Roth IRAs is 6000 or the total amount of money that your child made during the year whichever is less. Enter a few step-by-step details Enter a few step-by-step details in our Roth vs.

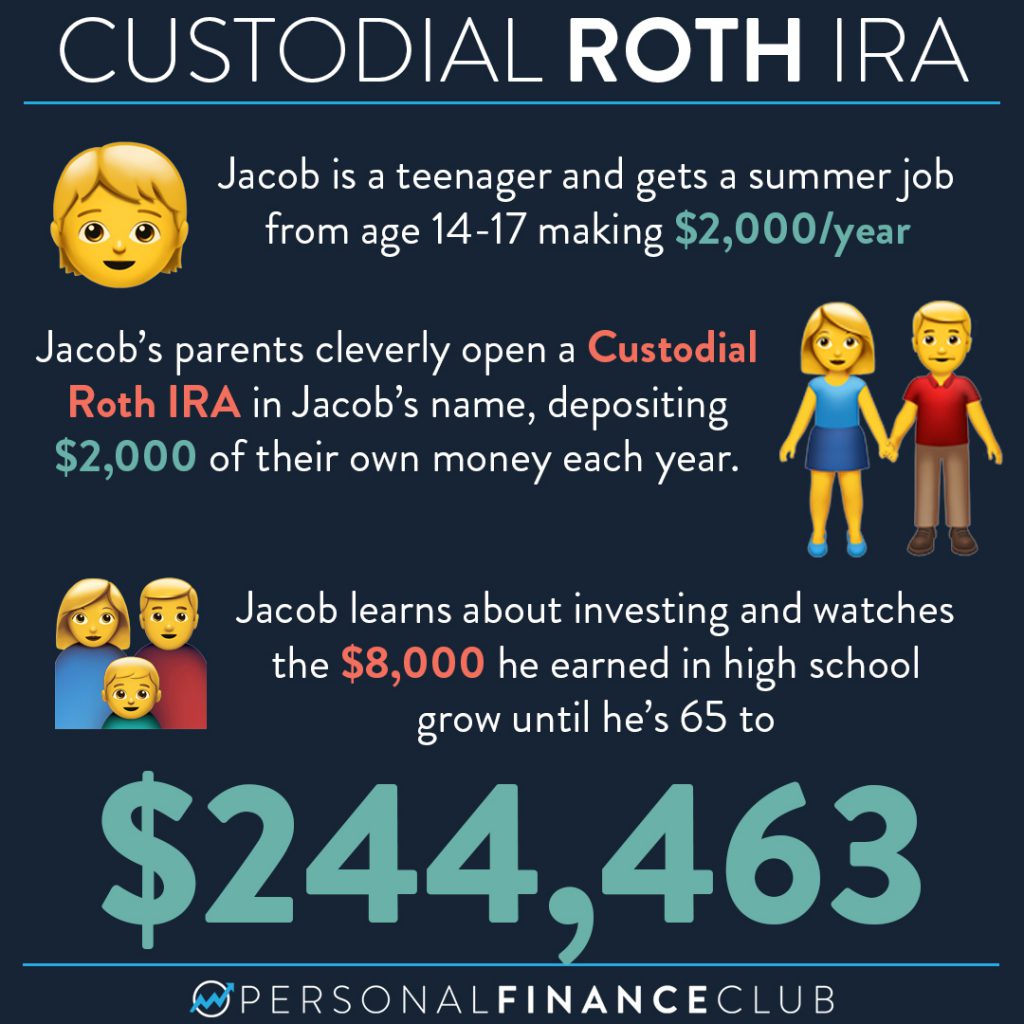

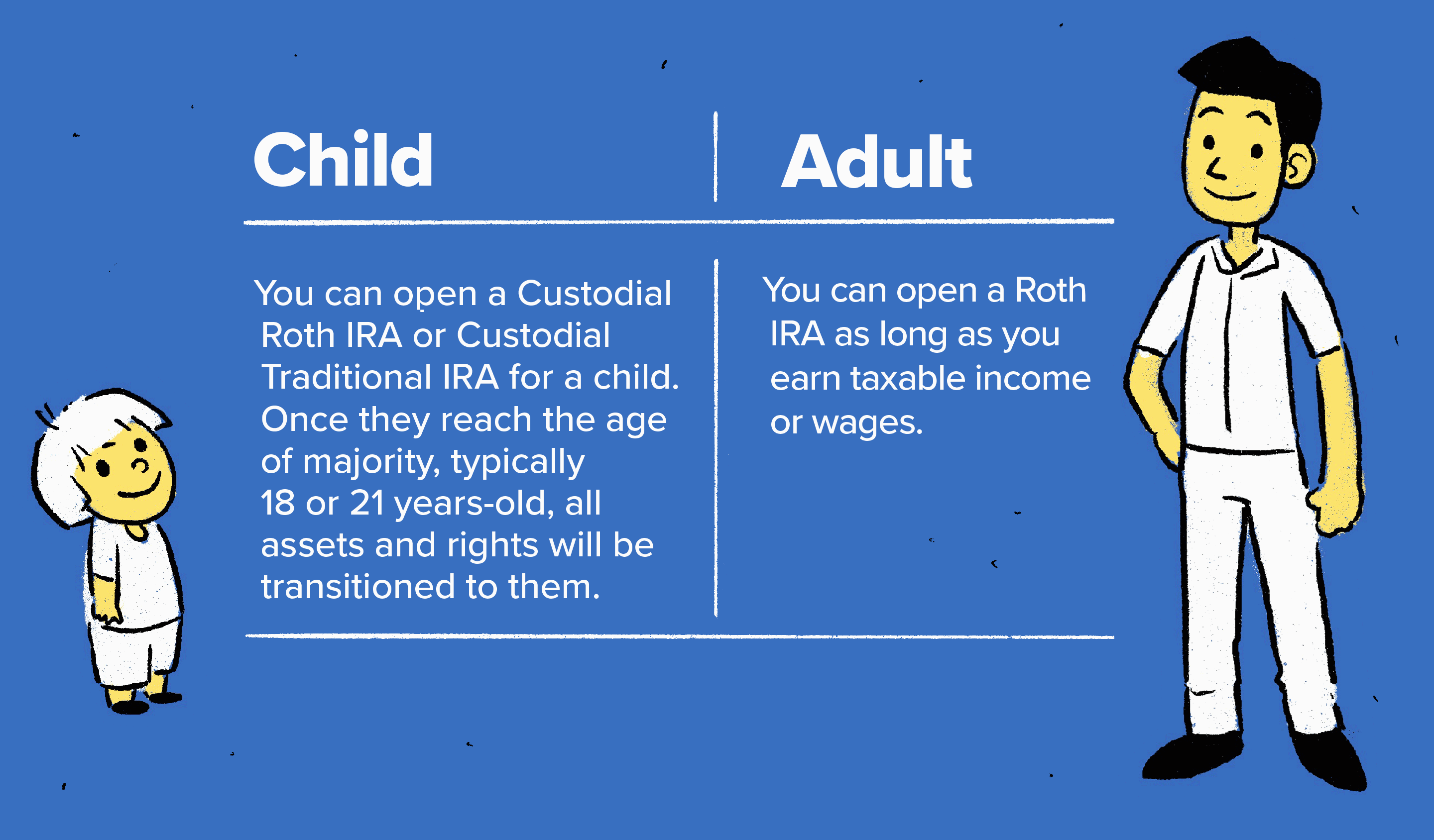

While long-term savings in a. A custodial IRA also known as a guardian IRA is a retirement account set up for a minor child by their parent grandparent legal guardian or other adult. In the case of a custodial Roth IRA this means your child must have earned income to contribute or for you to contribute on their behalf.

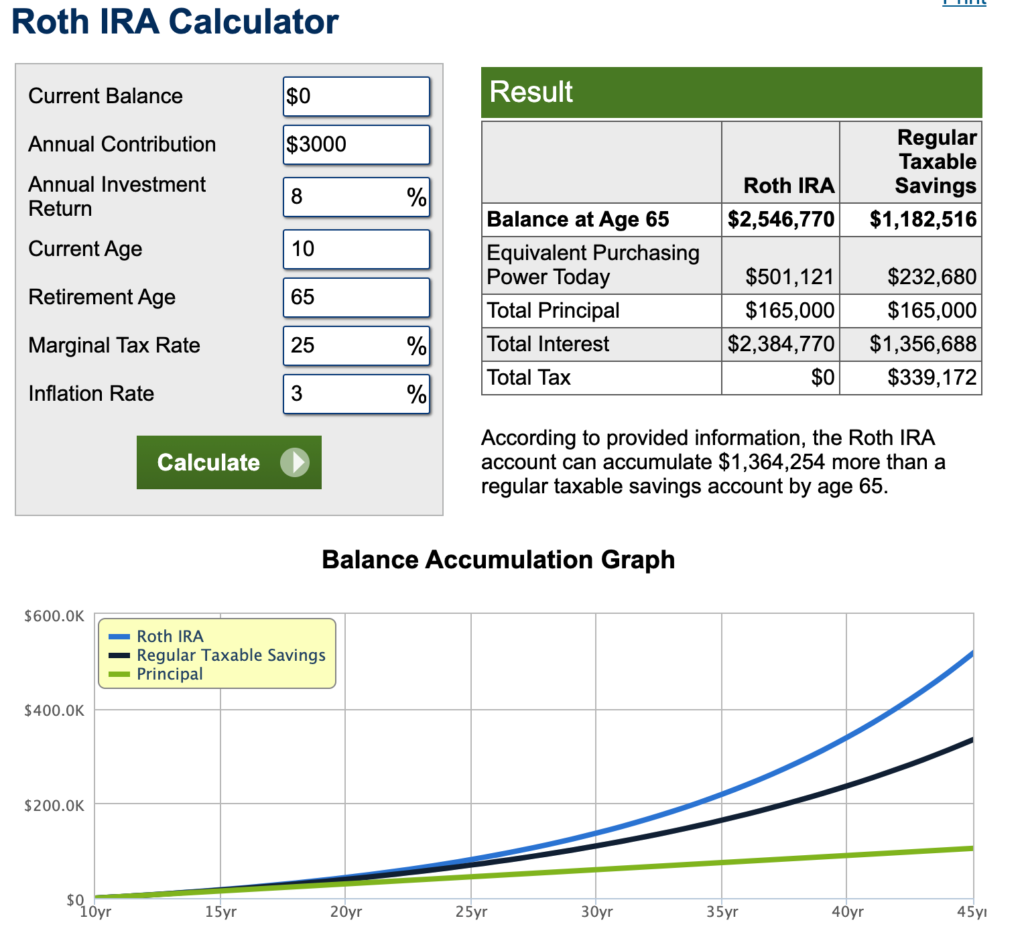

The table below offers a fairly comprehensive outline of. With the Roth IRA calculator you can get an idea of how much your earnings can grow if you start making contributions at a. The custodian maintains control of the childs Roth IRA including decisions about contributions investments and distributions.

For 2021 the contribution limit for custodial Roth IRAs is 6000 or the total amount of money that your child made during the year. With the Roth IRA calculator you can get an idea of how much your earnings can grow if you start making contributions at a young age. We cannot and do not.

Custodial Roth IRA contributions are limited to the lesser. Call For More Info. Ad Visit Fidelity for Retirement Planning Education and Tools.

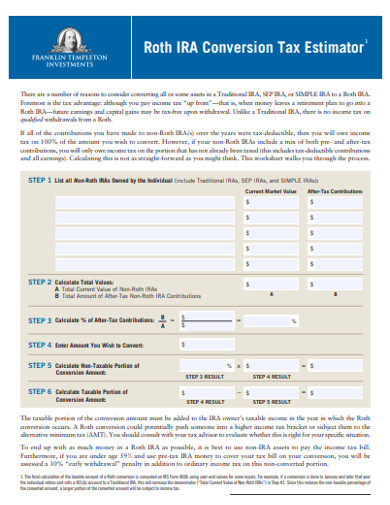

Help Give Your Minor A Head Start. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Fidelity Investments introduced a free online Roth IRA conversion calculator last month to both its independent registered investment advisers and.

Ad Explore Retirement Account with Tax Advantages. For example if your child earned 3000 mowing lawns theyd be. A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income.

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. Traditional IRA Calculator can help you decide. Roth IRA Based on age an income of and current savings of You will need about 6650 month in retirement Your IRA will contribute 2781 month in retirement at your.

Ad Learn More About Custodial IRAs. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. Ad Visit Fidelity for Retirement Planning Education and Tools.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. A custodial Roth IRA is managed on behalf of the account owner by an adult typically a parent or other custodian. For comparison purposes Roth IRA and regular taxable.

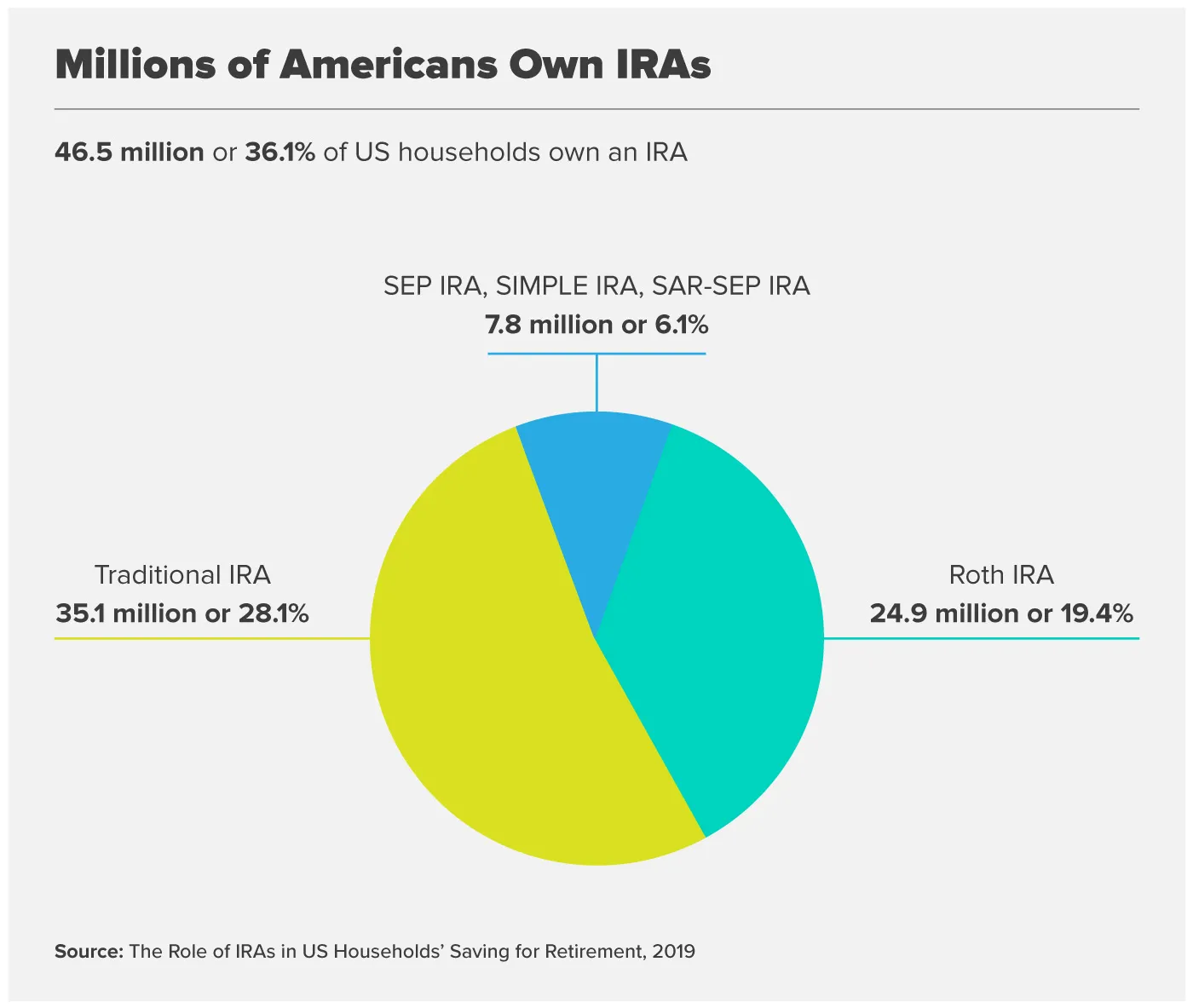

Retirement Savings Calculator. Call 866-855-5635 or open a Schwab IRA today. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

The Roth IRA contribution limit in 2021 is the lesser of 6000 or your childs total compensation for the year. In addition statements are sent to the custodian. The child owns the.

What is a Custodial IRA.

Roth Ira For Kids A Truly Life Changing Strategy See The Forest Through The Trees

Custodial Roth Ira Retirement Accounts For Minors

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Roth Ira Calculator 2022 Thrivent

5 Roth Ira Calculator Templates In Pdf Free Premium Templates

How To Open A Roth Ira 5 Easy Steps Seeking Alpha

3jyzvuocctnujm

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

How To Open A Custodial Roth Ira For Your Kids Personal Finance Club

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

What Is A Roth Ira Money Com

What Is An Ira Money Com

A Roth Ira At Age 15 Thanks To The Parent Match

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most